For years now, high demand for property and gravity-defying house prices have made the UK property market a seller’s dream. But there are signs that in 2023, the balance is likely to tip in favour of buyers instead. Here is why 2023 is shaping up to be a dream for certain types of buyers.

House prices will fall

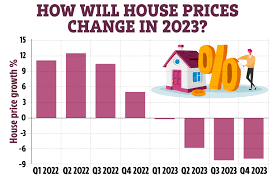

Despite the cost of living crisis and high mortgage rates, house prices have remained high and the market relatively buoyant. But experts are predicting the property bubble is poised to burst soon and 2023 is likely to be the year that prices finally fall. This follows a period of unprecedented demand as homebuyers rushed to take advantage of the stamp duty holiday, introduced in 2020 in a bid to stimulate the property market during the Covid 19 pandemic. This move helped to drive up house prices and demand to exceptional levels.

Now, higher mortgage rates are expected to become a major barrier to moving and, coupled with the cost of living crisis, will send house prices in a downward trajectory. How much house prices are likely to fall is still a matter of debate but lower prices will be good news for certain buyers in 2023. It will be especially good news for first time buyers who do not have a property to sell. However, sellers should remember that their own property prices will be falling from exceptionally high levels anyway, and the fall in prices will mean they are likely to get a better deal on their own new home too. Falling house prices will also be good news for cash buyers who are unaffected by high lending rates.

More room to negotiate

As prices begin to fall, so too will confidence in the property market, and many will decide now is the time to stay put. This will also help to make it more of a buyers’ property market. Demand for property is likely to fall and there will be less competition, meaning those who do want to buy may have more power to negotiate. In contrast, figures show that 36% of homes for sale attracted offers from three or more buyers in the first quarter of 2021. Demand is predicted to fall as house prices and confidence in the market do too.

While homebuyers are likely to see cheaper house prices, they still need to be aware of the total package of costs involved in buying a property. Stamp duty charges are back in force, while it is also wise to invest in a homebuyers survey. Designed to investigate the structural integrity of a property, a homebuyers survey cost is anywhere between £300 and £1,200 depending on the type required. You can even use online resources to research a homebuyers survey quote, such as: https://www.samconveyancing.co.uk/news/house-survey/homebuyers-survey-cost-9958.

In conclusion, 2023 is shaping up to be a property buyers’ market but until mortgage rates begin to fall, it is mainly first-time buyers and cash buyers who will benefit.